We see lots of adverts and articles about Care Fees, Wills and Trusts.

But there are lots of misunderstandings about what the fees are and how they are funded. And whether your home needs to be sold to fund care. And many more about how a Will or a Trust can help you and your family. Let’s start with some basics:

Care Fees – an overview of who pays for what.

If you can no longer look after yourself, you may need to move into a care environment. Who pays depends on your needs. If your care is the responsibility of the NHS (because it is predominantly nursing care) then it is provided free of charge.

To qualify for free care, you must be eligible for “Continuing Health Care” (CHC). You must pass an assessment which should be conducted according to the National Framework. A meeting will determine if you have a “primary health need”. If so, your care must be provided in a registered nursing home, and will qualify for NHS Funding.

If you do not have a “primary health need” then your care can be provided by the local authority. The costs are then means tested and charged on a sliding scale.

- If you have assets* over £23,250, you will have to fund the care yourself.

- If you have assets* of between £14,250 and £23,250, you will need to contribute towards the cost of your care. This will be from income such as pensions and a tariff based on your assets. The local authority will fund the rest.

- Once your assets* reaches below £14,250, you will no longer pay a ‘tariff’ income based on your assets. However, you must continue paying from income included in the means test. The local authority pay the remaining cost of your care.

- A note on “assets”. This includes savings, premium bonds etc.,

- It CAN include your property if it is not occupied by another qualifying relative. This can be a child, your spouse/partner or a relative over 60).

- In most cases no one will force your home to be sold, but they can ask for a charge to be placed on the property. That would be payable when you die

- These figures are for England. The allowances are different in Wales and Scotland

There are some excellent examples and scenarios in this blog by the Society of Will Writers. Note that the proposals to amend the limits have been pushed back to 2025.

Care Fees, Wills and Trusts – a trust in your Will.

Many couples we help decide to include a Property Protection Trust (PPT) in their Wills. Effectively this means that if one of you die, their share of the home will be held safely in a trust, allowing you to still live there for as long as needed. It is most often used for couples worried about their children being disinherited in the event of future remarriage.

However, it can also have benefits around care fees. If you need care after your spouse/partner has died, only your share of the property can be assessed as part of your assets. Their share can’t be taken into account.

If you’d like more information about a Protective Property Trust, you can read our recent blog. Remember a Will Trust doesn’t come into force until the first of you dies, and you are not giving up control of your home.

You can also place other assets into this type of “Life Interest Trust” so you can protect more than just your property.

You do need to be careful that you are not only doing this to avoid care fees. If the local authority suspects that you have deliberately deprived them of including assets in your financial assessment, they can still treat it is as if you owned them.

So the critical thing is to do a Will with a PPT while you are young, fit and healthy. then there is no argument to be had!

Care Fees, Wills and Trusts – putting your home in trust.

Every week we get someone calling asking if they can put their home into trust to avoid care fees. For many, the conversation starts with a friend mentioning that someone they know did this. But do they ever tell you if it works?

If you own your home solely and don’t have anyone living with you, it may be tempting to consider placing your home into trust. Or as a couple, you may be on the receiving end of some pretty persuasive marketing from companies who tell you this is possible. But beware!

This type of trust involves you giving up your home to a trust while you are alive. That means you no longer own it and no longer have any control of it. All decisions would need to be made by the trustees.

But most importantly, if the local authority suspect that you only did this to avoid paying care fees, they will treat it as if you still own it. You will then have to find the funds to cover the costs.

Care Fees, Wills and Trusts – giving your home to your children.

Similarly, we get lots of calls asking if it would be sensible to just sign over the home to the children, to avoid care fees later.

Just like giving your home to a trust, you also run the risk of the local authority deciding this was only done to deprive them of assets from which you could otherwise pay for your care.

But more importantly, you are now living in a house that someone else owns. We have seen lots of sad cases where children have fallen out with their parents and this has caused major issues. You can read about a recent high profile case of a daughter trying to evict her elderly mother.

And if your son or daughter gets divorced, their share of your home will be taken into consideration in a divorce settlement. We have a client whose mother is in exactly that position. Her Mum had gifted the house to her and her brother. When her brother divorced, his ex-wide was awarded half of his share of the house. To pay her that amount, the house had to be sold and our client’s mother is now living in a much smaller property.

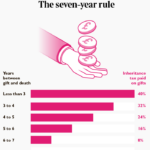

Care Fees, Wills and Trusts – the 7 year myth.

Finally, we hear lots of confusion about “the 7-year rule”. “If I give away assets and survive 7 years, the council can’t use them for care fees“

This really isn’t the case! The “7-year rule” relates to inheritance tax only. You can gift assets away and they don’t count in your estate for IHT purposes.

But the local authority can go back as far as they wish to determine if you gave away assets with the sole purpose of committing deliberate deprivation.

I hope this overview has been useful. We can provide more detailed information for you and offer a free 30-minute consultation to discuss any questions you have about protecting your home and assets for your family. Or if you have any questions about care and the funding process, we can help you with that too.

Just give us a call on 01524 571032 and our team will be there to help!